Cost-Volume-Profit (CVP) Analysis is a financial tool used by businesses to understand the relationship between costs, sales volume, and profits. It helps in decision-making by analyzing how changes in costs and sales levels affect profitability.

Key Components of CVP Analysis

- Costs that do not change with the level of production or sales, such as rent, salaries, or insurance.

- Costs that change directly with the level of production or sales, like raw materials or sales commissions.

Sales Price per Unit:

- The amount charged to customers for each unit of product or service sold.

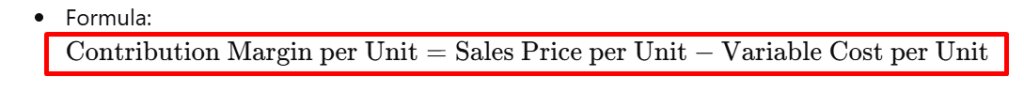

Contribution Margin:

- The difference between the sales price per unit and the variable cost per unit.

Applications of CVP Analysis

Pricing Decisions:

- Helps determine the impact of price changes on profitability.

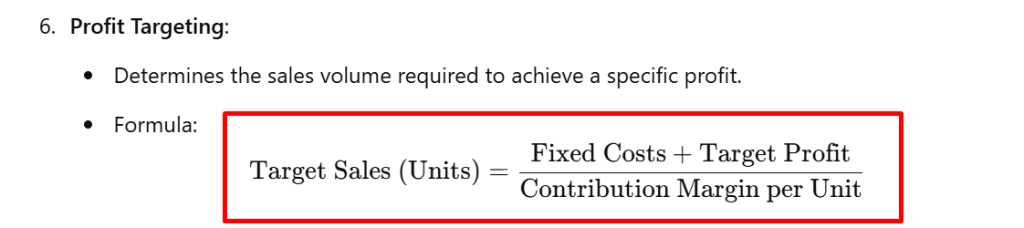

Profit Planning:

- Assists in setting sales targets to achieve desired profits.

Cost Control:

- Identifies how changes in fixed and variable costs affect profitability.

Evaluating New Investments:

- Analyzes the financial feasibility of new projects or product lines.

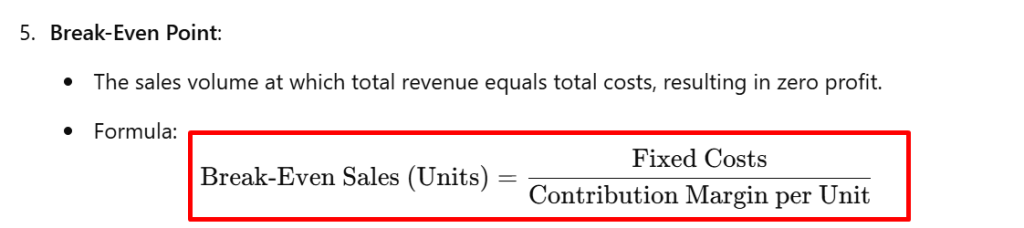

Break-Even Analysis:

- Determines the minimum sales volume needed to avoid losses.

About Variable cost : Click Hear

Facebook

Twitter

LinkedIn

Pingback: Allowance for bad debts - Accounting Talking